Open Enrolment Benefits UK: How to Choose the Right Options

Understand UK open enrolment benefits, compare schemes for EVs and bikes, weigh up private medical insurance, and see how these choices affect your tax and take-home pay for 2025/26.

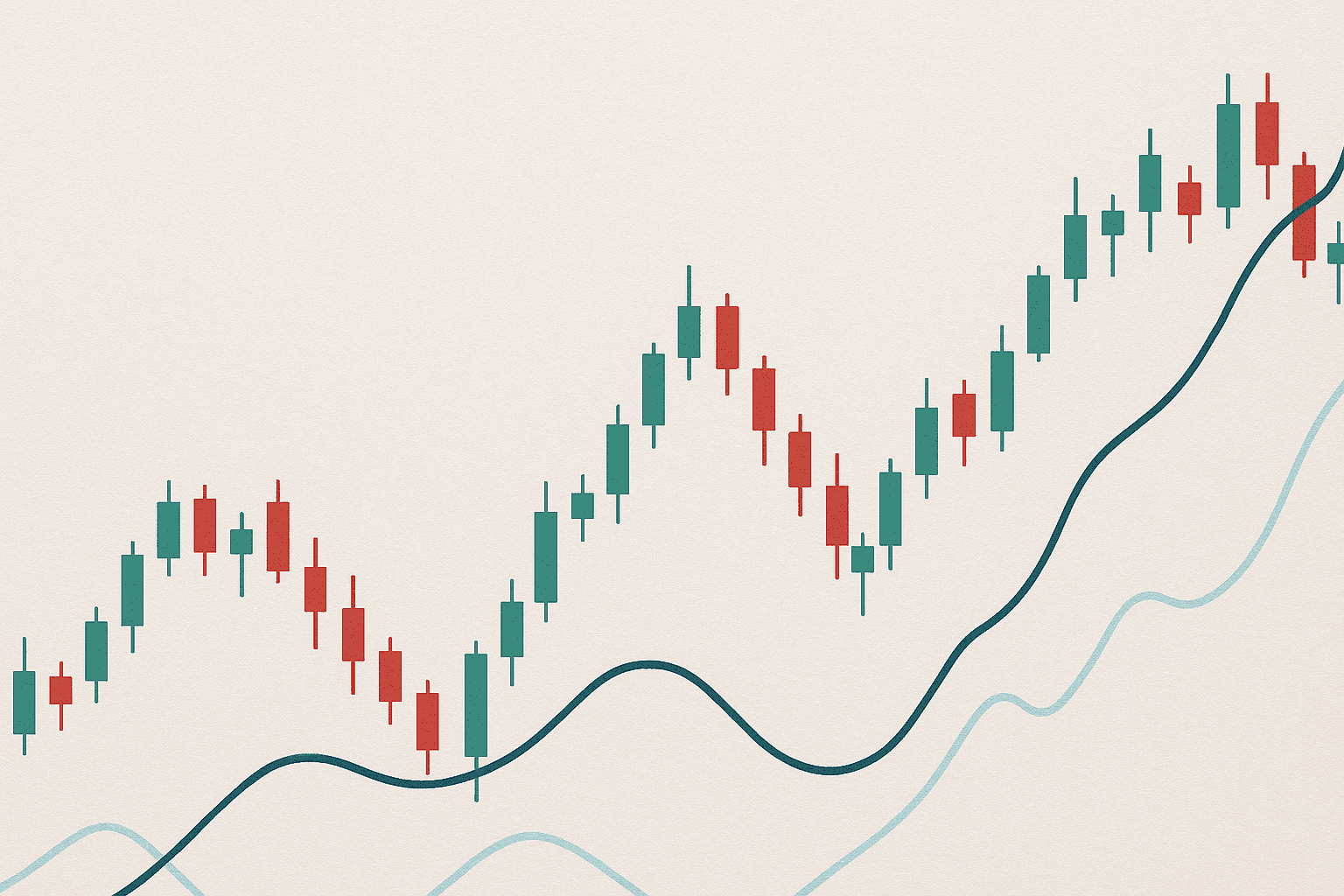

A guide for you on the ins and outs of UK bonuses, RSUs, and vesting tax—specifically selling to cover versus holding, timing tips, and practical examples to aid your planning efforts.

Continue reading →

We use cookies to improve your experience, measure traffic, and show relevant ads. You can accept or reject optional cookies. See our Privacy Policy.